Top Two Strategies for Margin Trading Success

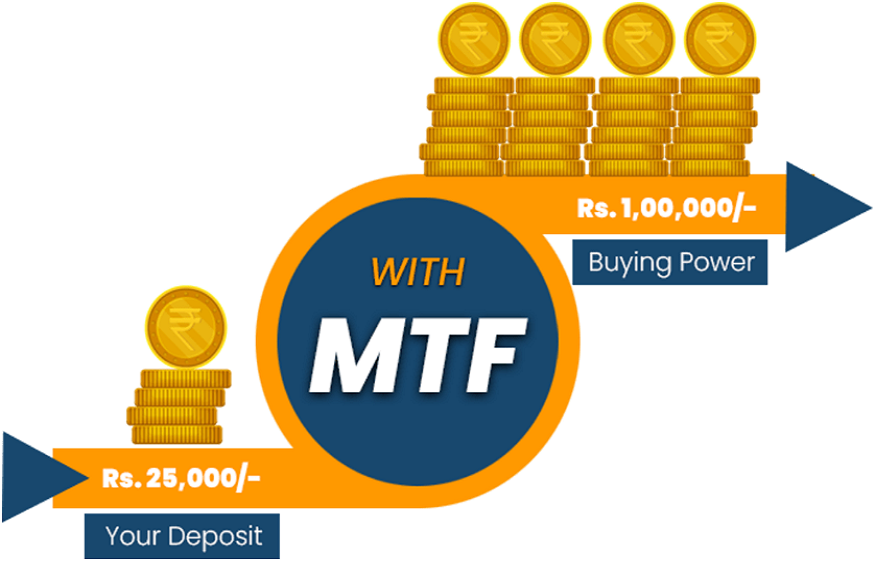

Margin trading allows investors to amplify potential returns by borrowing funds to trade larger positions. While it offers substantial profit opportunities, it also carries significant risks. To succeed in margin trading, traders must adopt well-thought-out strategies. Two of the most effective strategies are risk management and timing the market using technical analysis.

1. Effective Risk Management

Risk management is the cornerstone of a successful margin trading facility. Since margin trading amplifies both gains and losses, managing risk is crucial to avoid significant losses. Traders should only use a portion of their available margin to ensure they can withstand market volatility. Setting stop-loss orders is a vital risk management tool; it automatically closes a position at a predetermined loss level, limiting potential damage. Additionally, position sizing—deciding how much capital to allocate to each trade—is essential. Over-leveraging can lead to margin calls, where traders must deposit more funds or sell assets to maintain the position. A disciplined approach to risk management protects capital and ensures traders can stay in the game long enough to realize profits.

2. Timing the Market with Technical Analysis

Technical analysis helps traders make informed decisions by studying historical price movements and trading volumes. Margin traders benefit significantly from using technical indicators like moving averages, relative strength index (RSI), and Bollinger Bands to determine entry and exit points. For example, moving averages can help identify trends, while RSI highlights overbought or oversold conditions, signaling potential price reversals. Proper market timing ensures that traders open positions when the probability of profit is highest, reducing the risk of forced liquidation due to adverse price movements.

Conclusion

Margin trading success hinges on disciplined risk management and precise market timing through technical analysis. By mastering these strategies, traders can harness the power of leverage while minimizing the risks associated with margin trading.

The Future of Investing: The Rise of 3-in-1 Demat Accounts

The landscape of investing is rapidly evolving, driven by technology and the demand for seamless financial experiences. One of the most notable advancements is the rise of 3-in-1 Demat accounts, which integrate a Demat account, trading account, and savings bank account into a single platform. This all-in-one solution is revolutionizing how investors manage and grow their wealth, offering unparalleled convenience, efficiency, and security.

Traditionally, investors had to open separate accounts for trading, holding securities, and managing funds, leading to cumbersome processes and delayed transactions. The 3-in-1 Demat account eliminates these barriers by linking all three accounts, enabling instant fund transfers, faster settlement of trades, and simplified portfolio management. This streamlined approach not only saves time but also reduces the complexities associated with managing multiple accounts.

As retail participation in the stock market surges, especially among young and tech-savvy investors, the demand for user-friendly investment solutions is at an all-time high. The 3-in-1 Demat account caters perfectly to this demographic by offering seamless mobile trading apps, real-time portfolio tracking, and personalized investment advice. Furthermore, with robust security features and regulatory oversight, these accounts provide a safe environment for both novice and seasoned investors.

Looking ahead, the future of investing will be defined by integration and accessibility. The popularity of 3-in-1 Demat accounts reflects a broader trend toward frictionless financial services. As more brokerage firms and banks adopt this model, investors can expect enhanced features such as AI-driven investment recommendations, personalized financial planning, and deeper market insights.

In conclusion, the rise of 3-in-1 Demat accounts marks a pivotal shift in the investment ecosystem. By combining convenience, speed, and security, they are shaping the future of investing, making wealth creation more accessible and efficient than ever before.

Post Comment

You must be logged in to post a comment.